You’ve probably heard the word altcoin tossed around in the crypto world and wondered what it actually means. Put simply: any cryptocurrency that isn’t Bitcoin is considered an altcoin—short for alternative coin.

Altcoins exist for many reasons. Some are cheaper to buy. Others are built on different codebases to improve speed, scalability, or features beyond Bitcoin. Some serve unique purposes in the cryptocurrency market, from powering apps to enabling smart contracts.

In this guide, you’ll get clear answers to common questions: What is an altcoin? What types are out there? How do they work? When is the right time to trade them? What’s altcoin season—and how do you spot it?

What Are Altcoins?

Altcoins are cryptocurrencies created as alternatives to Bitcoin. The term covers every coin that launched after Bitcoin’s 2009 debut, including Ethereum, Dogecoin, Solana, Tether, and thousands more.

While Bitcoin was built as a decentralized payment network, altcoins go beyond Bitcoin with new functions, designs, and use cases.

Some altcoins, like Bitcoin Cash, are created by forking Bitcoin’s code. Others are built from scratch or launched on the Ethereum blockchain. They power smart contracts, run decentralized apps, and support specific platforms or ecosystems.

Even Ethereum (ETH) is technically an altcoin despite being the second most popular coin. However, many in crypto treat Bitcoin and Ethereum as separate pillars.

Altcoins aren’t just copies—they often aim to fix what Bitcoin can’t or offer new solutions in blockchain technology and the broader cryptocurrency market.

Types of Altcoins

Altcoins fall into several key categories, each designed for different use cases in the digital currency space:

- Stablecoins: These aim to maintain a stable value by being tied to real-world assets like the US Dollar. They reduce volatility and are often used for trading. Examples: USDT, USDC, DAI

- Utility Tokens: These tokens serve a specific function within a platform, such as paying for services, storage, or transaction fees. Example: Filecoin (FIL)

- Governance Tokens: These give holders voting rights on protocol changes, upgrades, and platform rules. They support decentralized decision-making. Example: Uniswap (UNI)

- Meme Coins: Meme coins started as jokes but gained popularity through community hype and social media buzz. Example: Dogecoin (DOGE)

- Privacy Coins: These are designed for anonymous transactions by hiding details like wallet addresses and transfer amounts. Example: Monero (XMR)

- Fork-Based Coins: Some altcoins are created by forking Bitcoin’s code, often aiming to improve speed or scalability. Examples: Bitcoin Cash (BCH), Bitcoin SV (BSV)

- Platform Coins: These power blockchain networks and support smart contracts or dApps. Example: Ethereum (ETH)

- Security Tokens: These represent shares in real-world assets or investments, and they are and they are often used in Security Token Offerings (STOs).

How Altcoins Work

Altcoins are built on their own or shared blockchain networks. Some are based on the Ethereum blockchain, while others operate on custom infrastructures. Most rely on smart contracts to run apps or services without central control.

They use consensus mechanisms, such as Proof of Work (PoW) or Proof of Stake (PoS), to verify transactions and keep the network secure.

Each coin has unique tokenomics—rules for supply, rewards, and distribution. For example, Litecoin has a fixed supply, while Dogecoin does not, which affects its long-term value differently.

Many altcoins offer faster transaction speeds and lower transaction fees than Bitcoin, which is why they’re often used in payments, apps, or specialized services.

Their value depends on real-world use, active communities, and the strength of the ecosystem behind them.

History of Altcoins

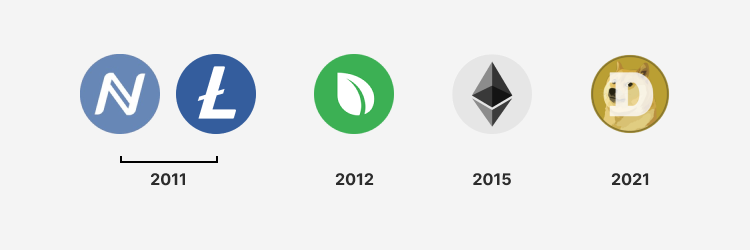

Most altcoins emerged after Bitcoin, starting with experiments to improve its design. The first was Namecoin in 2011, which aimed to decentralize domain name control.

Later that year, Litecoin launched as a faster, lighter alternative to Bitcoin. It helped introduce ideas like quicker block times and capped supply.

Peercoin came soon after, pioneering the Proof of Stake model to cut energy use.

In 2015, Ethereum changed everything by launching a platform for smart contracts and decentralized apps. It opened the door to DeFi, NFTs, and countless other projects.

As the market matured, meme coins like Dogecoin also gained popularity, driven by culture and community rather than technical innovation.

Some coins, like Bitcoin Cash, were born from Bitcoin forks. Others filled specific needs—like privacy, storage, or governance.

Altcoins have continued to evolve with every new trend and market wave.

How Do Altcoins Compare to Bitcoin?

Altcoins and Bitcoin are both cryptocurrencies, but they serve different roles in the crypto space. Here’s how they compare:

- Use Cases and Technology: Bitcoin is a store of value and medium of exchange. Altcoins go beyond Bitcoin with smart contracts, staking, and new applications. Many use Bitcoin technologies such as Proof of Stake.

- Speed and Cost: Bitcoin transactions can be slow and expensive. Altcoins like Litecoin offer faster transaction speeds and lower fees, making them more practical for daily use.

- Security and Decentralization: Bitcoin is the most secure and decentralized, with widespread mining support. Bitcoin altcoins vary—some are secure, others have smaller, more centralized networks.

- Community Size and Adoption: Bitcoin has global recognition and the strongest user base. Altcoins like Ethereum have large communities too, but many altcoins serve niche audiences with limited adoptions.

Understanding the Altcoin Market

The altcoin market is diverse, fast-moving, and shaped by trends. Here’s what to know:

- Market Makeup: Altcoins range from major coins like ETH to small digital assets with unique use cases.

- Market Size: Altcoins make up a large part of the crypto market cap, but their share shifts often.

- Altcoin Dominance: This measures how much of the crypto market is controlled by altcoins compared to Bitcoin. A rise signals growing altcoin strength.

- Market Shifts: New tech, changing regulations, or investor trends can shift the altcoin market quickly.

- Price Fluctuations: Altcoin prices move fast—more than Bitcoin. They react sharply to news, hype, and speculation.

- Market Sentiment: Sentiment drives demand. Bullish vibes lift prices, but bad news can crash them just as fast.

- Volatility: Altcoins are volatile digital assets. Gains can be massive—but so can the losses.

What Is Altcoin Season?

Altcoin season is a period when altcoins outperform Bitcoin. It usually starts after Bitcoin has stabilized or risen in price. During this time, traders move capital from Bitcoin into altcoins, lowering Bitcoin dominance and boosting altcoin prices.

You can track this using the altcoin season index, which compares performance between altcoins and Bitcoin.

It’s a high-risk, high-reward window in the altcoin market—short-lived and highly speculative.

Key Indicators to Identify Altcoin Season

Watch for these signs that the next altcoin season may be starting:

- A noticeable drop in Bitcoin dominance

- Altcoin trading volume spikes across exchanges

- A wave of bullish market sentiment on social media

- A rise in the altcoin season index showing outperformance

Investing in Altcoins: Pros and Cons

Altcoins come with benefits and risks. Here’s a breakdown:

Pros

- Lower transaction fees

- Faster transaction speeds

- Higher growth potential than Bitcoin

- Useful for exploring digital assets and market trends

- Some projects solve perceived limitations in the crypto space

Cons

- High volatility and market risk

- Many altcoin projects fail

- Scams and rug pulls are common

- Regulations are unclear or changing

- It can be complex for beginners

How to Buy Altcoins

Getting started with trading altcoins is simple if you follow these steps:

- Join a crypto exchange: Pick platforms that support a wide range of coins (e.g., Binance, Kraken, Coinbase).

- Add funds: Use fiat currencies like USD or transfer BTC/ETH from your crypto wallet.

- Buy altcoins: Search and select coins in the trading altcoins section.

- Store your altcoins: Use a hot wallet for easy access or a cold wallet for safer long-term storage.

This process opens the door to participating in the broader cryptocurrency market.

Best Practices for Trading Altcoins

Trading altcoins requires planning, discipline, and strategy. Here are the essentials:

- Watch market sentiment: Use tools like LunarCrush or CoinGecko to track real-time interest and momentum.

- Set stop-loss orders: Define how much you will lose before trading. This protects your capital.

- Avoid emotional trades: Decisions should be based on market trends and data, not fear or FOMO.

- Follow project updates: Changes in roadmaps or partnerships can impact a coin’s value. Stay informed to stay ahead.

These habits help you stay grounded in the fast-moving crypto space.

The Future of Altcoins

The future of altcoins depends on utility and real-world value. Many blockchain projects are just duplicates with new names. They don’t solve real problems, and most will vanish.

But the altcoins that last will be those that offer practical, scalable, and well-adopted digital currency solutions.

As the cryptocurrency market matures, expect consolidation around a few strong projects. The noise will fade, and the real value will rise.

FAQs About Altcoins

What are the top 3 altcoins?

The top altcoins by market cap are Ethereum (ETH), BNB, and Solana (SOL). Ethereum powers smart contracts and DeFi. BNB is used for fees on Binance. Solana is known for fast speeds and low altcoin prices.

What is an example of an altcoin?

Cardano (ADA) is a good example of a utility token. It’s a proof-of-stake blockchain used for smart contracts and dApps. It was designed to support secure and scalable decentralized systems.

How much is 1 altcoin worth?

Altcoin prices vary. Some trade below $1, like Dogecoin. Others, like Ethereum, are worth over $1,000. You can check live prices on CoinMarketCap or CoinGecko.

How does altcoin season work?

Altcoin season starts when altcoins outperform Bitcoin. It usually follows a Bitcoin rally, as traders shift profits into smaller coins. It’s fast-moving and heavily influenced by sentiment.

Can I get rich trading altcoins?

Trading altcoins can be profitable, but it’s risky. Prices move fast. Success depends on timing, solid research, and risk control—not luck. Never invest what you can’t afford to lose.

Are governance tokens safe?

Governance tokens give holders voting power. Their safety depends on the project’s code, team, and adoption. Some grow in value, others fail. Research is key before investing.

Final Thoughts on Altcoins

Altcoins have expanded the crypto universe far beyond Bitcoin. From Ethereum to niche alternative coins, they’ve added flexibility, innovation, and choice to the altcoin market.

But not all altcoins are equal. Some offer real solutions. Others are just noise.

If you’re thinking about trading altcoins, remember that timing, research, and risk management matter. Study the project, know your exit, and protect your wallet.

Understanding what altcoin is is just the beginning. To thrive in this space, you need strategy—not luck.