A hot wallet is a crypto wallet connected to the internet. It stores private and public keys, letting users send, receive, and manage digital assets instantly. It’s the go-to option for everyday transactions.

Unlike cold wallets, which stay offline for security, hot wallets offer convenience but are more vulnerable to hacks. They’re great for quick access but shouldn’t hold large amounts of crypto. This guide covers everything you need to know to choose the best storage option.

What is a Hot Wallet

A hot wallet is a digital wallet that keeps your crypto connected to the internet. It’s great for quick access and transactions, making it a convenient choice for daily use. But since it’s always online, it comes with higher security risks.

There are two types: custodial and non-custodial. Custodial wallets store private keys on an exchange, meaning they handle security. Non-custodial wallets keep private keys in your hands, giving you full control but more responsibility. Popular options include MetaMask, Trust Wallet, and Coinbase.

How Does a Hot Wallet Work?

A cryptocurrency wallet works like a digital bank, letting you store, send, and receive crypto. A hot wallet stays connected to the internet, making transactions easy but also increasing security risks. It holds two crypto keys: a public key (your address for receiving funds) and a private key (which controls access to your assets).

When you send crypto, your hot wallet signs the transaction using your private key and broadcasts it to the blockchain. The recipient’s public key acts as the destination, and once verified, the funds arrive.

Unlike a cold wallet (which stays offline) or paper wallets (which store keys physically), a hot wallet trades security for convenience in the online environment. To stay safe, always enable two-factor authentication and use strong passwords—because in the crypto world, one breach can mean losing everything in one wallet.

What Is the Safest Hot Wallet?

Some cryptocurrency wallets offer stronger security than others. Non-custodial wallets like MetaMask and Exodus let you control your keys, reducing risk. But even the most secure hot wallets are still online, making them more vulnerable than a hardware wallet.

Trust Wallet adds PIN protection and biometric logins. MetaMask supports hardware wallets for extra safety. Coinbase Wallet offers 2FA and cloud backups, but online storage has risks. No matter which you choose, enable every security feature and never store large amounts in a hot wallet.

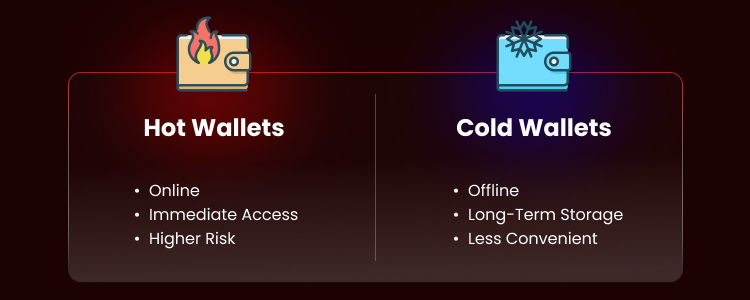

Hot Wallet vs. Cold Wallet

A hot wallet stays connected to the internet, making crypto transactions fast and convenient. A cold crypto wallet keeps private keys offline, stored on a physical device or paper wallets for better security. The trade-off? Hot wallets are easier to use but riskier, while cold wallets provide offline storage but are less accessible.

Hot Wallet vs. Cold Wallet Comparison

| Feature | Hot Wallet | Cold Wallet |

| Usability | Easy to access, ideal for daily transactions | Less convenient, mainly for long-term storage |

| How They Work | Always online, storing keys on apps or web-based platforms | Keeps keys offline, requiring a connection for transactions |

| Security | More vulnerable to hacks due to constant internet connection | Highly secure as it remains offline |

| Storage | Stores keys on connected devices (mobile, desktop, or web | Stores crypro keys offline (hardware or paper wallets) |

| Transaction Speed | Fast and seamless | Slower, requires additional steps to connect and sign transactions |

| Examples | MetaMask, Trust Wallet, Coinbase Wallet | Ledger Nano X, Trezor Model T, Paper Wallets |

| Best For | Active traders and frequent crypto users | Long-term investors (hodlers) and secure asset storage |

Are Hot Wallets More Secure Than Cold Wallets?

No, cold storage is safer. Keeping crypto keys offline protects them from malware, phishing, and hacking attempts. Cold wallets act as offline vaults, making theft nearly impossible unless someone physically steals your device.

But they’re not perfect. Lose the physical device or forget your recovery phrase, and your funds are gone forever. Hot wallets are better for small amounts and frequent use, but always enable 2FA, use strong passwords, and never store large amounts in one wallet.

Types of Hot Wallets

Here are the common types of hot wallets:

- Software Wallets: These crypto wallets run on desktop or mobile devices, offering control over private keys. They provide convenience but are vulnerable to malware and hacks.

- Exchange Wallets: Built into exchange accounts, these wallets store funds on the platform. They are easy to use but rely on the exchange’s security, making them riskier if the platform is hacked.

- Web-Based Wallets: These wallets operate through a browser app, allowing access from any device. While convenient, they are more exposed to phishing and online threats.

How to Keep Your Hot Wallet Secure

- Enable 2FA: Adds an extra layer of protection.

- Regularly update your wallet: Fixes security vulnerabilities.

- Use strong passwords: Harder to crack, reducing risk.

- Store seed phrase securely: A defining feature of non-custodial wallets; only you should have access.

When Should You Use a Hot Wallet?

Hot wallets are perfect for daily transactions. If you need fast access to your crypto, here’s when they make sense:

- Everyday payments: Buy goods and services instantly.

- Active trading: Move funds between exchanges quickly.

- Staking & DeFi: Required for staking, lending, and yield farming.

- Small storage: Keep only what you need for frequent use.

For larger holdings? A cold wallet is the safer bet.

FAQs About Hot Wallets

What is the difference between a hot wallet and a cold wallet?

Hot wallets stay online, making them easy to use but less secure. Cold wallets keep public and private keys offline, protecting them from hackers. Hot wallets are great for transactions, while cold wallets are best for long-term storage. Using both is smart.

Is Coinbase a hot wallet?

Yes, Coinbase offers a custodial hot wallet, meaning it controls your keys. This makes sending and receiving cryptocurrency easy but increases risks. It also has a self-custody wallet, where you control security. For safety, transfer funds to a cold wallet when needed.

What are the risks of a hot wallet?

Hot wallets face potential risks like hacking, phishing, and malware due to their online nature. If someone steals your public and private keys, your funds are gone. Use many hot wallets to spread risk and always enable 2FA for better protection.

Is a hot wallet safe for storing large amounts of cryptocurrency?

No, hot wallets are not safe for storing large amounts of money. They are always connected to the internet, making them easier to hack. For security, store large holdings in a cold crypto wallet and keep only small amounts in hot wallets.

Can I use multiple hot wallets?

Yes, using many hot wallets can help you manage different cryptocurrencies and reduce risk. If one is hacked, your other funds stay safe. Just make sure each wallet has a strong password and 2FA for added security.

How do I recover a lost hot wallet?

If you lose access to your smartphone, use your seed phrase to recover it. Without this, your funds are lost forever. Store the seed phrase safely, offline. Never share it or store it in an online application for security reasons.

What are the best practices for securing my hot wallet?

Use a strong password, enable two-factor authentication (2FA), and keep your seed phrase offline. Avoid using public Wi-Fi when accessing your wallet. Never store wallet details in a bank account or any unsecured online application.

Hot Wallets: Final Thoughts

Hot wallets keep crypto handy but aren’t built for long-term storage. Use them for quick transactions, not your life savings.

Stay secure. Turn on 2FA, use strong passwords, and don’t keep too much in one place. Watch out for scams and malware. For real security? Keep most funds in cold storage and use hot wallets only when needed.