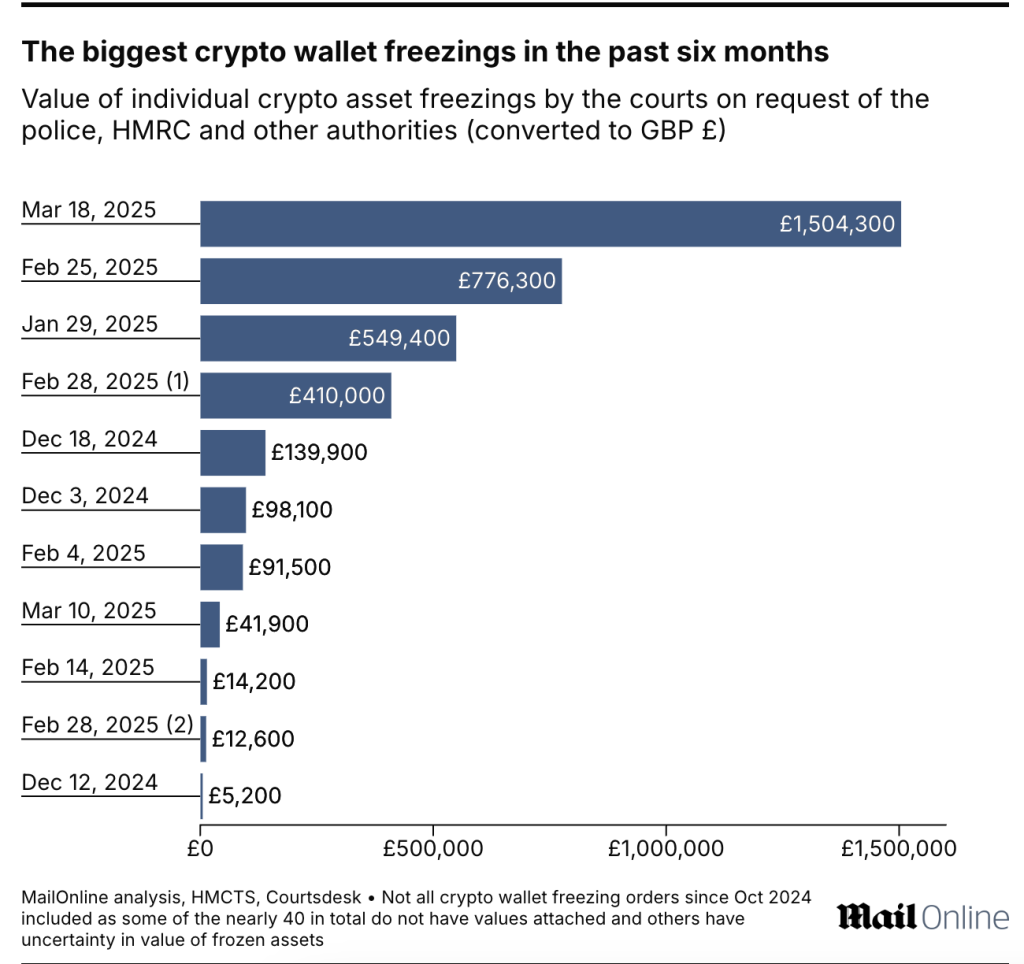

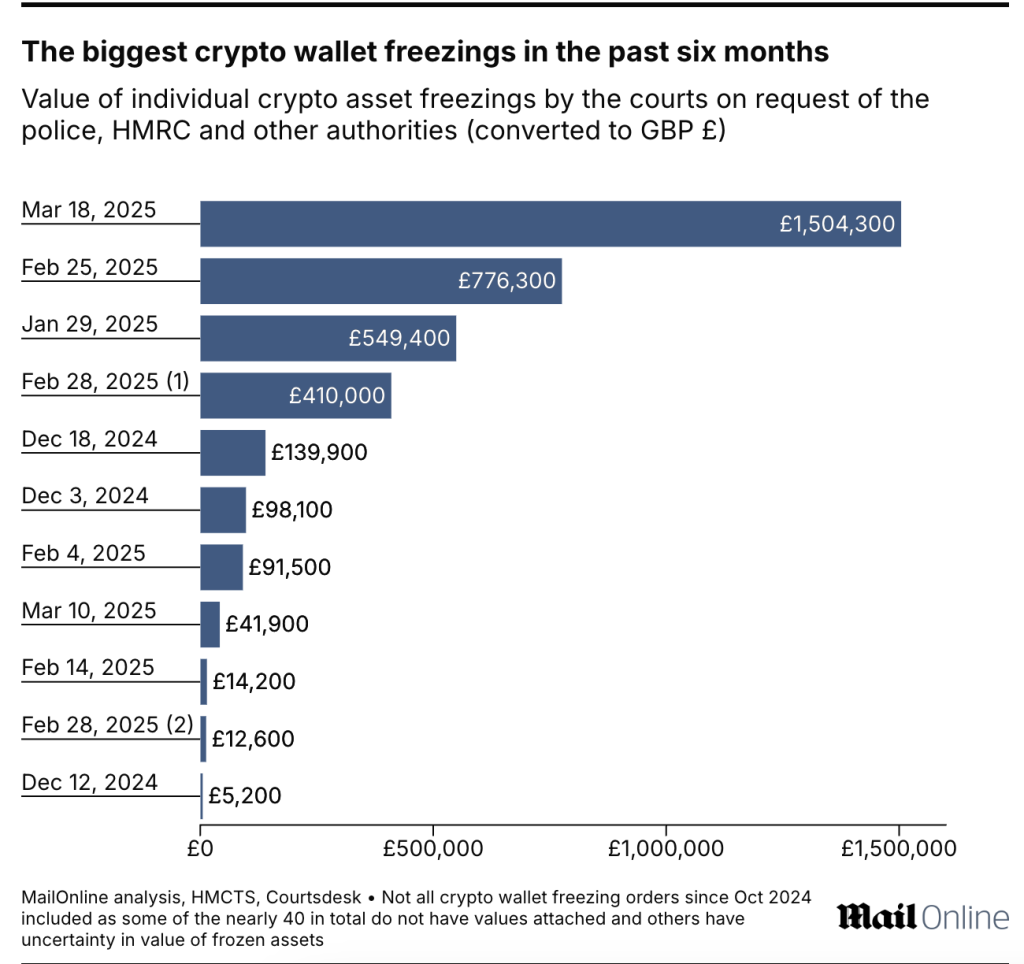

UK authorities have frozen $7.7 million in cryptocurrency tied to criminal activity since gaining new enforcement powers last April. The single largest freeze targeted a $1.94 million wallet hosted on Coinbase.

The National Crime Agency (NCA), police forces, and HM Revenue and Customs (HMRC) can now freeze suspicious crypto wallets for up to three years without notifying suspects, according to court documents reviewed by MailOnline. The biggest freeze order was issued on March 18 at Newcastle Upon Tyne Magistrates’ Court.

Source: MailOnline

Nick Barnard, a crypto legal expert at Corker Binning, called the $7.7 million figure relatively modest “in the grand scheme” compared to global crypto transactions. He noted that the UK’s enforcement system started from scratch last year.

Barnard told MailOnline that the new regime came from a “standing start” last April, so it needs time to “get up to speed.”

Authorities target cryptocurrencies used for money laundering, tax evasion, and terrorism financing. Under the new rules, they can freeze, seize, and even destroy crypto assets if deemed harmful to the public.

The freezing process prevents suspects from moving funds while investigations proceed. Most actions target wallets on centralized exchanges like Coinbase. Private wallets secured by personal keys remain difficult for authorities to access.

“If police have a major investigation into organized criminals laundering money through crypto, they will go in and seize the assets before they finalize the investigation,” said Siobhain Egan, director of Lewis Nedas Law.

Egan warned that more enforcement is coming: “We are fully expecting a tsunami of crypto freezing orders down the track.”

Several challenges slow enforcement efforts. Many frozen wallets belong to foreign nationals, complicating cases. Additionally, most investigators lack specialized crypto knowledge, and traditional cash remains the primary method for money laundering.

The UK government continues strengthening crypto enforcement through the Crime and Policing Bill, which includes provisions for valuing digital assets and recovering illicit funds.

Last year, in the UK’s biggest crypto case, authorities seized Bitcoin worth $5.8 billion (£4.5 billion) from Jian Wen, who was jailed for laundering proceeds from an investment fraud that affected 128,000 people.