Crypto investment products lost $795 million last week as ongoing U.S.-China trade disputes under President Trump sent investors fleeing for the third straight week, according to a new CoinShares report released on April 15.

Since February, frightened investors have pulled $7.2 billion from crypto funds, nearly wiping out all 2025 gains. Only $165 million in net inflows remain for the year.

“Recent tariff activity continues to weigh on sentiment towards the asset class,” said James Butterfill, Head of Research at CoinShares. The uncertainty has hit Bitcoin hardest, accounting for $751 million of last week’s outflows.

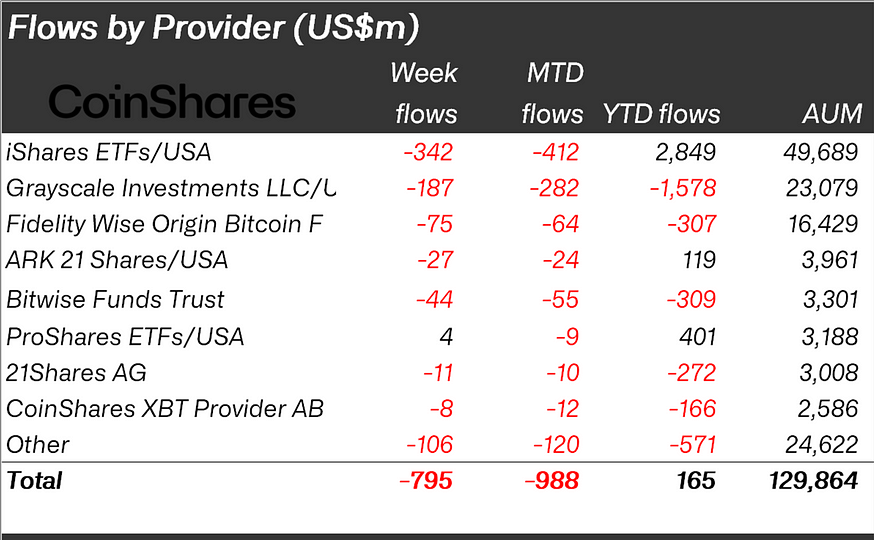

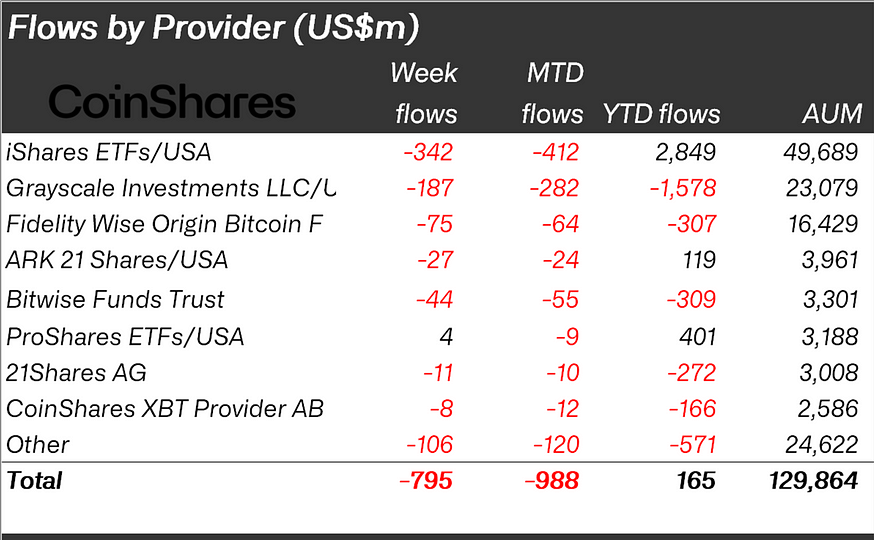

Source: CoinShares

A late-week price recovery offered some relief after President Trump temporarily rolled back some tariffs. This policy change helped boost total assets under management (AUM) by 8% to $130 billion from their April 8 low.

The United States dominated regional outflows, contributing $763 million or 96% of the total. Switzerland lost $11.9 million and Hong Kong saw $11.2 million in withdrawals.

“This sharp reversal reflects growing unease over inflation, regulatory noise, and looming liquidity risks,” a CoinShares strategist noted in the report.

Source: CoinShares

Bitcoin ETF providers suffered significant losses. iShares ETFs lost $342 million, Grayscale Investments saw $187 million exit, and Fidelity experienced $75 million in outflows. Only ProShares ETFs bucked the trend with a modest $4 million in inflows.

Despite these heavy withdrawals, Bitcoin still maintains $545 million in year-to-date inflows, with AUM valued at nearly $113 billion. Ethereum, the second-largest cryptocurrency, lost $37.6 million last week but retains $241 million in 2025 inflows.

A few smaller cryptocurrencies attracted investment against the negative trend. XRP led with $3.4 million in inflows, while Ondo, Algorand, and Avalanche each gained under $500,000.

Several countries showed resilience amid the downturn. Canada added $2.1 million, while Brazil and Australia recorded minor inflows of $0.2 million and $0.4 million, respectively.

The crypto market’s late-week price rebound coincided with Bitcoin rising 10%, partly making up for earlier losses. Current data shows Bitcoin trading around $85,000, recovering from early-month lows but still affected by ongoing trade tensions.