Managing digital assets safely is essential for every crypto user. There are two main storage options: hot wallets and cold wallets. Choosing the right method affects how easily you access funds and how securely you store them.

A hot wallet stays connected to the internet, making it perfect for fast access and regular transactions. A cold wallet, also known as cold storage, keeps your crypto offline for better protection.

This guide compares hot wallet and cold wallet setups to help you choose the right crypto wallet for your usage, risk level, and investment size.

What Is a Crypto Wallet?

A crypto wallet lets you send, receive, and store cryptocurrencies. It doesn’t hold coins—it stores private keys, unlocking access to your blockchain funds.

There are two types of keys:

- Public keys: like your account number, shared to receive funds

- Private keys: your secret digital signature, used to authorize crypto transactions

Protecting your private key is critical. If someone gets access, they can control your crypto.

There are two main types of crypto wallets:

- Software wallets (online, mobile, browser)

- Hardware wallets (offline physical devices)

Each handles key storage differently, which is key to security and access control.

What Is a Hot Wallet?

A hot wallet is a software-based wallet that is always connected to the internet. It runs on your desktop, mobile device, or browser. Because it’s online, it offers easier access to your funds and quick transactions.

Hot wallets are perfect for everyday use. They’re common among traders, casual users, and anyone interacting with dApps or exchanges.

Examples of top crypto wallets in this category:

- Coinbase – software hot wallet from a leading exchange

- Zengo – a secure, mobile-only hot wallet

- Cybherock – a hybrid option with strong security, used primarily as a hot wallet

Pros and Cons of Hot Wallets

Here are the major advantages and drawbacks of hot wallets:

Pros

- Quick access for regular transactions

- Free to use and easy to set up

- Support many coins and dApps

- Often feature simple, user-friendly designs

Cons

- Exposed to online threats like hacking or malware

- Vulnerable to malicious smart contracts

- Not ideal for storing large balances

- Constant connection increases risk

What Is a Cold Wallet?

A cold wallet is a wallet not connected to the internet. It stores your crypto offline, keeping your crypto keys offline and out of reach from hackers and malware. This method is known as cold storage.

Most cold wallets are hardware wallets—physical devices made for offline storage. They hold your private keys securely, even during transactions. The most popular options include:

- Ledger Nano X – Hardware wallet with Bluetooth and mobile support

- Ledger Stax – Premium hardware wallet with touchscreen display

- Ledger Nano S Plus – Affordable, reliable hardware wallet for secure key storage

Paper wallets are another type of cold crypto wallet, where keys are printed and stored safely offline. However, most users now prefer dedicated cold storage wallets like the Ledger series for better usability and durability.

Pros and Cons of Cold Wallets

The strengths and weaknesses of cold wallets include:

Pros

- Strong offline storage shields against online attacks

- Ideal for long-term storage

- Only you hold the crypto keys

- A hardware wallet is a tamper-resistant hardware device

Cons

- Not suited for frequent trading

- Setup requires a physical device

- It can resemble a thumb drive, so the risk of loss exists

- Quality wallets aren’t free like hot wallets

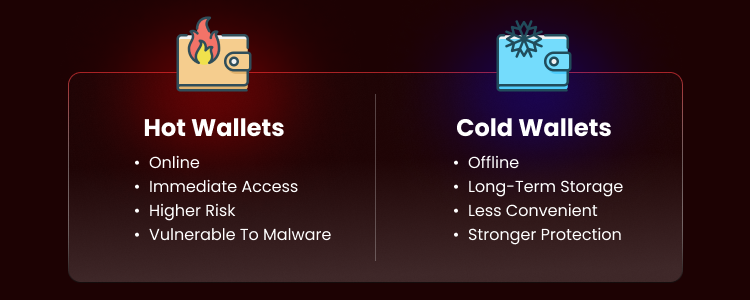

Hot and Cold Wallets: Key Differences

Understanding the trade-offs between hot and cold wallets helps you manage crypto safely. Here’s a breakdown of the main categories:

1. Internet connection

- A hot wallet stays connected to the internet, making it faster but more exposed.

- A cold wallet works offline, keeping your crypto safer.

2. Convenience and access

- Hot wallets are convenient for fast, frequent use.

- Cold wallets require a physical device and manual steps to access funds.

3. Security measures

- Cold wallets offer stronger protection by staying offline.

- Hot wallets are more vulnerable to malware and phishing attacks.

4. Cost

- Hot wallets are often free.

- Cold wallets usually require a hardware wallet purchase.

5. Storage method

- Hot wallets use online software.

- Cold wallets store keys on a hardware wallet or paper wallet.

6. Usage frequency

- Hot wallets are suitable for daily use.

- Cold wallets are best for secure, long-term holding.

Hot Wallet vs Cold Wallet: How to Choose

Deciding between a hot wallet vs cold wallet depends on your habits and risk level. Use these questions to guide your choice.

- Transaction frequency: Active traders may prefer hot wallets for convenience. Long-term holders benefit from cold wallets.

- Risk level: If you prioritize being secure, cold wallets are safer. Hot wallets are better for low-value, quick-access needs.

- Investment size: Big crypto holdings deserve the safety of a cold wallet.

- Technical experience: Beginners may start with hot wallets, but should learn the different types across crypto platforms over time.

Can You Use Both Hot and Cold Wallets Together?

Yes. Many users combine hot and cold wallets. This storage method gives you the best of both worlds—access and protection.

Keep smaller amounts in your hot wallet for spending or DeFi activity. Store your savings in a cold wallet to protect your long-term digital assets.

Think of the hot wallet vs cold wallet strategy like checking vs savings accounts. One is for everyday use. The other is for keeping your funds safe.

Understanding Hardware Wallets

Hardware wallets are trusted cold storage tools. These hardware devices keep your private keys offline, safe from online malware.

They’re small, USB-style physical devices. To use them, connect to a computer and approve each transaction manually. Only the signed transaction goes online—your keys stay locked inside.

Popular brands:

- Ledger Nano

- Ledger Stax

- Trezor

A hardware wallet is a must-have for serious crypto holders for secure key management.

Paper Wallets and Seed Phrases

Paper wallets store public and private keys on printed paper. They are fully offline and can’t be hacked remotely. However, they are easy to lose, damage, or destroy.

Instead, many users rely on a seed phrase—a backup that restores their wallets if they are lost or stolen.

A recovery phrase, also called a secret recovery phrase, is usually 12–24 words. It’s generated during wallet setup and must be written down and stored safely, offline only.

Never save your seed phrase digitally. Whoever has the phrase controls your funds.

Security Tips for Crypto Wallets

Securing your crypto wallets requires ongoing diligence. Follow these essential security measures:

- Enable 2FA: Use Two-Factor Authentication on exchanges and hot wallets whenever possible. Adds a vital security layer.

- Offline Seed Phrases: Store your seed phrase/recovery phrase physically offline, never on a computer or cloud service.

- Trusted Devices: Access wallets only from malware-free devices. Use strong, unique passwords. Keep software updated.

- Regular Backups: Ensure you have reliable backups of your seed phrase. Test your recovery process periodically.

- Limit Hot Wallet Exposure: Keep only necessary funds in hot wallets. Transfer larger sums to cold storage.

- Verify Transactions: Double-check addresses before sending funds. Confirm details on your hardware wallet screen if applicable.

- Beware Phishing: Be vigilant against scams that steal private keys or seed phrases. Verify sources.

- Secure Physical Items: Protect hardware devices and paper backups from theft or damage. Consider secure locations.

Adhering to these practices significantly enhances the safety of your digital assets. Protect your crypto.

Setting Up a Hot Wallet

Setting up a hot wallet is generally straightforward. Begin by choosing a reputable software wallet provider. Consider supported cryptocurrencies, platform compatibility (desktop, mobile), and security features. Download from official sources only.

Install directly from the official extension store or provider website if using browser extensions. Verify authenticity carefully. Create a strong, unique password for the wallet. Enable 2FA if available. This helps secure initial access.

Crucially, back up the seed phrase. When the wallet generates it, write it down meticulously. Store it safely offline immediately. This seed phrase is your sole recovery method. Do not proceed without securing it properly. Your crypto wallet depends on it.

Setting Up a Cold Wallet

Setting up a cold wallet, especially a hardware wallet, involves physical steps. Purchase the device from the manufacturer or an authorized vendor. Follow the setup instructions precisely. Connect the hardware wallet to your computer. Install the necessary management software from the official source.

Initialize the device. This typically includes setting a PIN code for access. Choose a strong, memorable PIN. The device will generate your private key and display the recovery phrase (seed phrase). This is the most critical step.

Record the seed phrase accurately, verify it carefully, and store it securely offline. This ensures you can recover your offline storage if needed. Once the setup and backup are complete, you can transfer crypto to your new, highly secure cold wallet addresses.

FAQs About Hot and Cold Wallets

Which is better, hot or cold?

Neither is universally “better.” The choice of hot wallet vs. cold wallet depends on usage. Hot wallets offer convenience, while cold wallets provide higher security. Many use both.

Is Coinbase a hot or cold wallet?

The main Coinbase service functions as a custodial hot wallet, while the separate Coinbase Wallet app is a non-custodial hot wallet. Coinbase secures most customer funds in its own cold storage.

What are the disadvantages of a cold wallet?

Cold wallets are less convenient for frequent use. Hardware wallets have a cost. There is a risk of physical loss. The user bears full responsibility for security.

Is Robinhood a hot wallet?

Yes, Robinhood Crypto operates as a custodial hot wallet. Users transact through the platform, which manages the underlying keys.

What is a Bitcoin hot wallet?

Any online software wallet used to manage Bitcoin. Provides easy access but carries higher online threats.

What is a Bitcoin cold wallet?

An offline method (e.g., hardware wallet, paper wallet) for storing Bitcoin private keys. Offers maximum security for holdings.

Final Thoughts on Hot and Cold Wallets

Choosing the right crypto wallet depends on how you use and store your assets. A hot wallet offers speed and access, while a cold wallet keeps long-term funds secure.

Most users benefit from using both. Store daily funds in a hot wallet and protect the rest with cold storage.

Combining hot and cold wallets is the easiest way to stay flexible and safe.