Google Play has blocked 17 overseas cryptocurrency exchanges in South Korea after the government asked them to. Since March 25, South Korean users cannot download or update apps for popular platforms like KuCoin, MEXC, and Poloniex.

South Korea’s Financial Services Commission (FSC) ordered the block because these exchanges didn’t register as Virtual Asset Service Providers (VASPs) under local laws. The platforms broke the rules by offering services in Korean, advertising to local users, and allowing Korean won transactions.

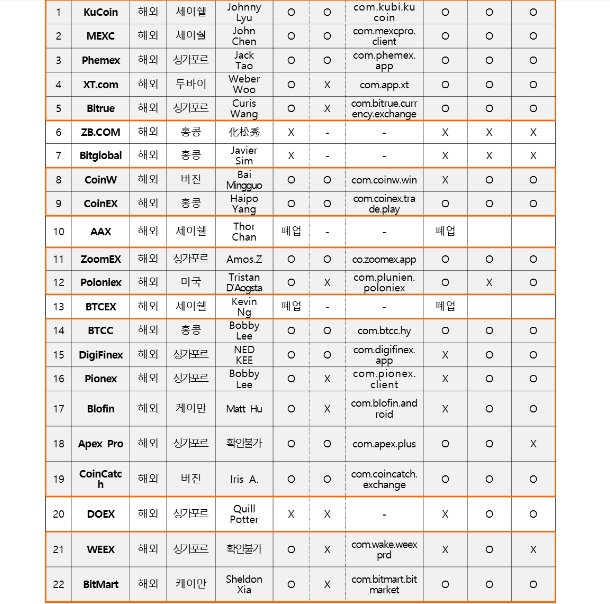

“Since March 25, at the request of the South Korean government, Google has implemented domestic access restrictions on 17 exchanges that are not registered in South Korea. Users cannot install new related applications or update them, including KuCoin, MEXC, Phemex, XT, Biture, CoinW, CoinEX, ZoomEX, Poloniex, BTCC, DigiFinex, Pionex, Blofin, Apex Pro, CoinCatch, WEEX, and BitMart,” reported Wu Blockchain.

Source: South Korea’s FSC

The block strengthens the dominance of domestic exchange Upbit, as it already controls over 70% of South Korea’s crypto trading market. People who already have the blocked apps can still use their accounts, but won’t get updates, which will make the apps work poorly over time.

This action follows similar blocks on 16 exchanges in 2022 and six more in 2023. Officials are now working with Apple Korea and the Korea Communications Standards Commission (KCSC) to extend these blocks to the App Store and websites.

The FSC said these measures help fight money laundering and protect investors from fraud. Companies that don’t follow the rules can face fines up to 50 million won (about $37,000) or even jail time.

“South Korea is one of the most active places when it comes to crypto trading, and we put great value into this market,” a KuCoin spokesperson told Cointelegraph. “We will stick with our commitment to compliance, not only to South Korea, but other regions too, to serve our users with trusted, secured and innovative products and services.”

Similar to India’s approach, South Korea blocked major platforms like Binance in January 2024. However, it differs from the United States and European Union, where regulators are creating broader rules.

Financial authorities are also looking into other issues in South Korea’s crypto world. On March 20, prosecutors raided Bithumb, one of the country’s largest exchanges, because a former board member allegedly used company money to buy a personal apartment.

The crackdown comes as crypto becomes more popular in South Korea, where over 30% of the population trades cryptocurrency, and exchange deposits doubled in late 2023. Some experts believe the stricter rules might actually attract big investors who want clear regulations before putting money into digital assets.