China is reshaping the global semiconductor market by outspending every other nation on chipmaking machines. In the first half of 2024, China spent a staggering $25 billion on semiconductor equipment, surpassing the combined spending of the U.S., South Korea, and Taiwan.

Indications suggest that this level of expenditure will persist throughout the latter half of the year, reaching $50 billion, with predictions of a 20% growth rate. This information was revealed at SEMI’s SEMICON trade event in Taiwan, where it was also predicted that China would lead in investments for new chip fabrication plants this year.

Strategic Implications

According to SEMI, China’s investment is not just about catching up but about setting the stage for long-term dominance in the semiconductor sector. In 2023, China spent nearly $37 billion on such equipment.

Clark Tseng, SEMI’s senior director of market intelligence, notes that China continues to purchase all available manufacturing equipment to bolster its chipmaking capabilities, particularly for mature processing nodes. “Concerns over potential further [export control] restrictions also pushed them to pull in and secure more equipment they could buy in advance,” Tseng said.

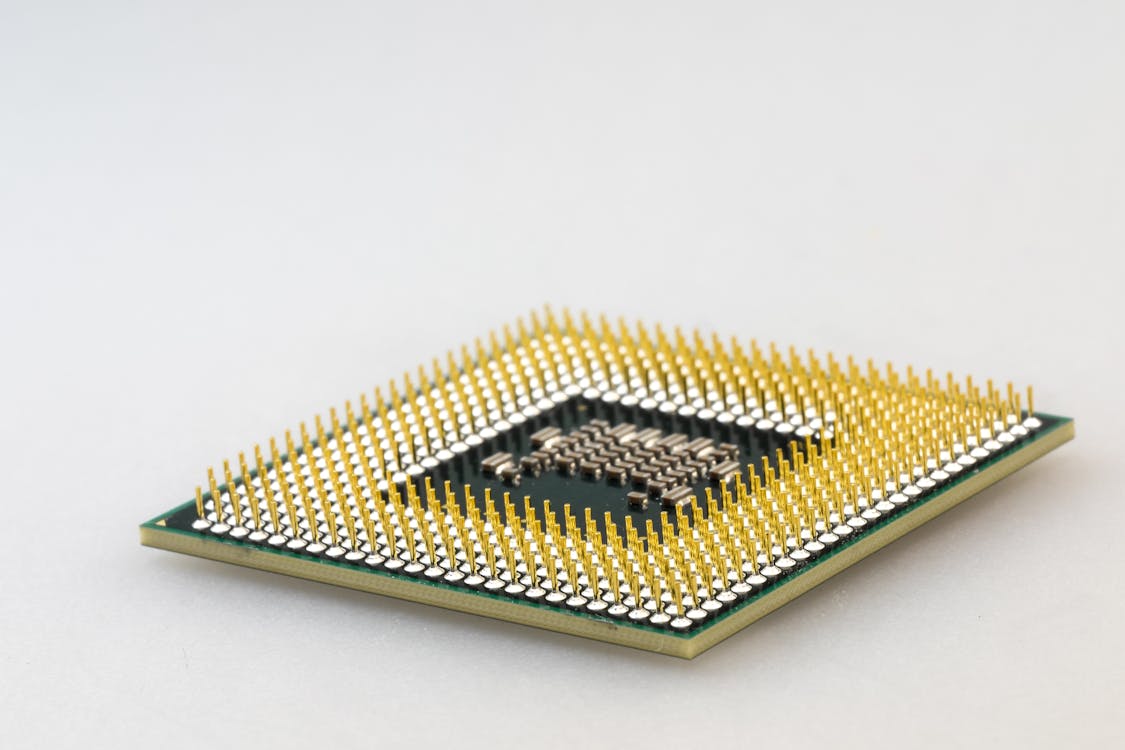

Most Chinese semiconductor fabs concentrate on trailing nodes because it is difficult for Chinese companies to acquire the technology necessary to manufacture chips using leading-edge processes.

The massive increase in spending aligns with Beijing’s ambition to achieve 70% self-sufficiency in semiconductors. To support this goal, China set up a $47.5 billion fund in May 2024 under the China Integrated Circuit Industry Investment Fund, or “Big Fund.” Local governments are also contributing, with Beijing recently establishing a $1.2 billion chip fund, while Shanghai doubled its chip fund’s value by adding $1 billion, channeling resources into projects led by Semiconductor Manufacturing International Corporation (SMIC) and Huawei.

China’s strategy is not limited to its top-tier manufacturers. It extends to over a dozen smaller and midsized chipmakers, all contributing to the nation’s goal of reducing reliance on foreign suppliers. This broad-based investment ensures that China remains the world’s largest market for chipmaking equipment, even as global economic conditions fluctuate.

Responding to U.S. Sanctions and its Global Impact

Experts have also seen this as a direct response to U.S. sanctions and export controls. The U.S. and its allies have imposed sanctions restricting China’s access to advanced chipmaking technology, prompting it to focus on developing its capabilities.

The Dutch company ASML, for example, has been banned from selling its most advanced extreme ultraviolet (EUV) lithography machines to Chinese firms. Despite these restrictions, ASML still derives 49% of its revenue from China, indicating the significant market that China represents.

Similarly, NVIDIA witnessed a 33.8% year-over-year increase in sales to the region in the second quarter of 2024.

Given that China constitutes a substantial market for corporations like NVIDIA and ASML, changes in investment trends could influence their revenue and strategic direction. Both may encounter difficulties in sustaining their revenue if China attains autonomy in semiconductor manufacturing.

In terms of public investment and industry subsidies, the Chinese government is outpacing the US, having allocated more than the amount of funding that the Biden administration has given thus far.

The implications of China’s spending spree are profound. For countries like the U.S., South Korea, and Taiwan, which have seen a decline in their chipmaking investments, this shift could lead to increased competition and potentially alter global supply chains.