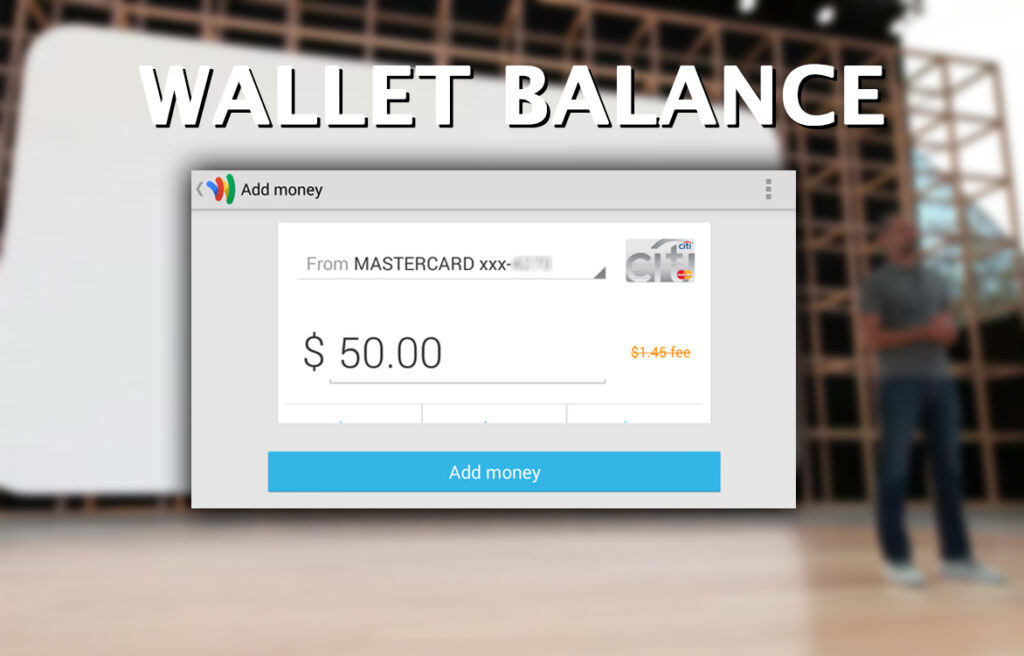

It’s one typical old-school plastic rectangle that is revered by the banking industry. A MasterCard powered by a debit card. But this card is wholly dependent on your Wallet account balance. It is similar to those prepaid Visa MasterCard gift cards you’re undoubtedly familiar with. Wallet accounts are their own pool of money. You first need to add money to your account by transferring funds from a bank account or a credit card.

Free options abound with the Wallet card. The card is free to order, activate, and fund with a bank account; there are no monthly or annual fees. Fees only appear when you load your Wallet balance with a credit card. And when withdrawing cash from an ATM. So be aware of those triggers. Grab the Wallet app to get started.

Ordering A Wallet Card

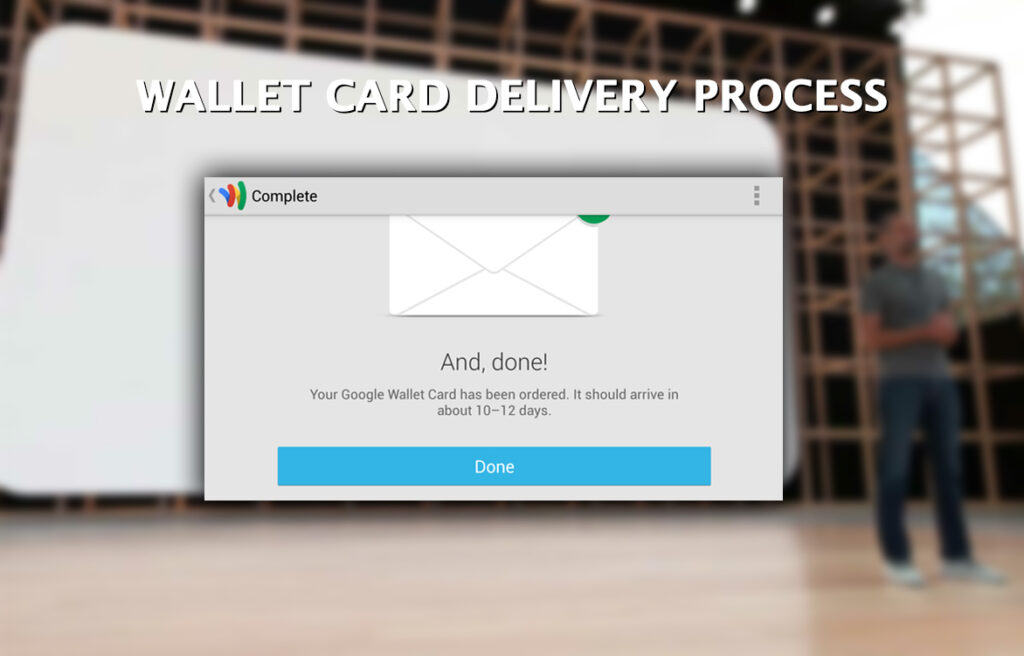

To be eligible for a Wallet card, you’ll need an account; you’ll need to accept the Wallet terms. You’ll need to verify your identity. Google says the verification is due to financial regulations and laws. Inside the Wallet Android app. Tap on the Wallet icon at the top left, then tap Send money from the menu. The Wallet will then ask you to verify your identity if you haven’t done so before. After identity verification, the Wallet card offers are presented inside the app. Tap on Getting your card in the offer box, and verify your mailing address. Then tap Send it to me to initiate the Wallet card delivery process.

Google estimates 10-12 days for the card to arrive, but I received mine in about a week. Once your card comes, you’ll need to activate it by entering the last 4 digits of the card number in the Android app or on the Wallet website.

Using The Wallet Card

To take my Wallet card for a spin. I first attempted to make a purchase with a zero balance in my Wallet account. As expected, the transaction was denied.

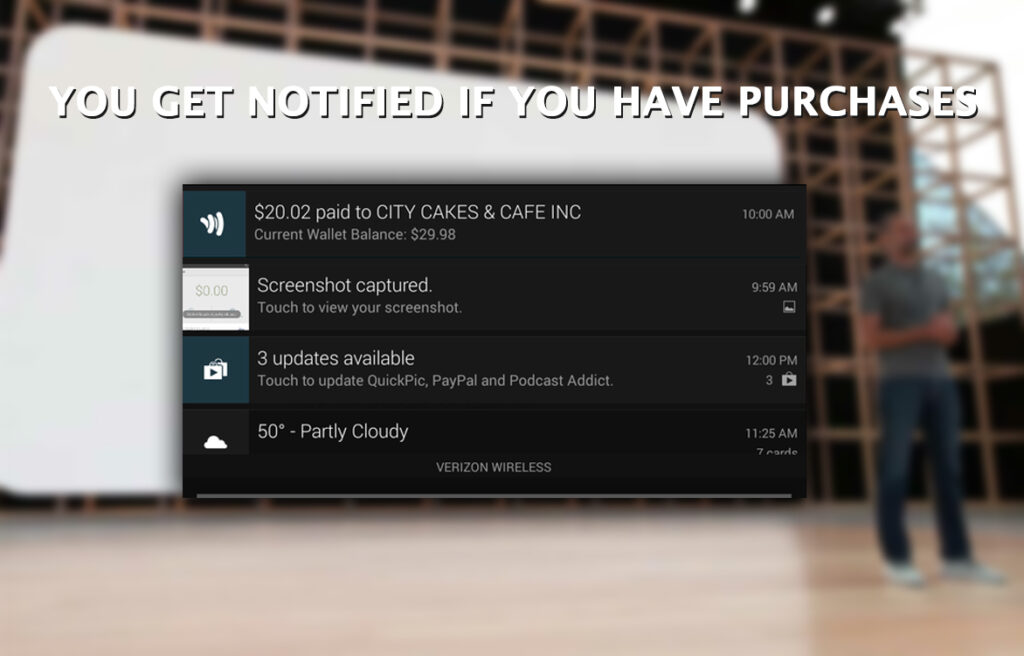

Fortunately, it’s rapid and easy to add funds to your wallet account using the Android app. Immediately after my first transaction was denied, I launched the Wallet app. I tapped on Add money to the Wallet Balance screen. Then add $50 using a credit card already saved in my Wallet account. I then handed my Wallet card back to the cashier to try again, and hey presto. The charge is approved. As noted previously, adding funds to your Wallet account via a credit card can incur fees. Waiving those fees during promotional periods. Often for the first time. You are adding funds to your Wallet account. The wallet has card-use notifications turned on by default. So you should receive a notice for purchase activity on all your devices with the Wallet app installed and active.

3 Reasons To Use Your Wallet Card

I’m sure you’re wondering what good a credit card lets you pay for things with your account. Isn’t it more work to fill up your account with money first? Having a fund-limited debit card that you can fill up with your smartphone has some good uses.

Security tool: Because your Wallet card depends on a fund-limited account, you can use it as a security buffer. Use your Wallet card if you’re making a purchase from a website or a merchant you don’t completely trust. Signing up for a service or a subscription that might auto-bill you repeatedly without your prior authorization? Wallet card time! The most that can be charged to the card is the available balance in the account.

Emergency card: Have the Wallet card in your car, at your office, or at another location for use as an emergency source of money. I’ve accidentally left my wallet at home more than I can remember. But with a Wallet card in the car. I could have quickly added money to my account using the Android app. I could have a MasterCard and no genuine wallet required.

Debit card for the kids: The Wallet card can be an excellent option for kids. Who might overspend if they had a card that worked on credit? But one that works off a limited account balance? If the youngster needs to purchase a higher-priced item. A quick phone call to Mom or Dad could initiate adding more money to the Wallet account. Providing a fast funding solution for just about any occasion.