Cryptocurrency exchange-traded products (ETP) lost $876 million last week, continuing a four-week losing streak that has now erased $4.75 billion from the market. CoinShares released these numbers on March 11, revealing stark differences in how investors across regions are responding to market pressures.

Source: CoinShares

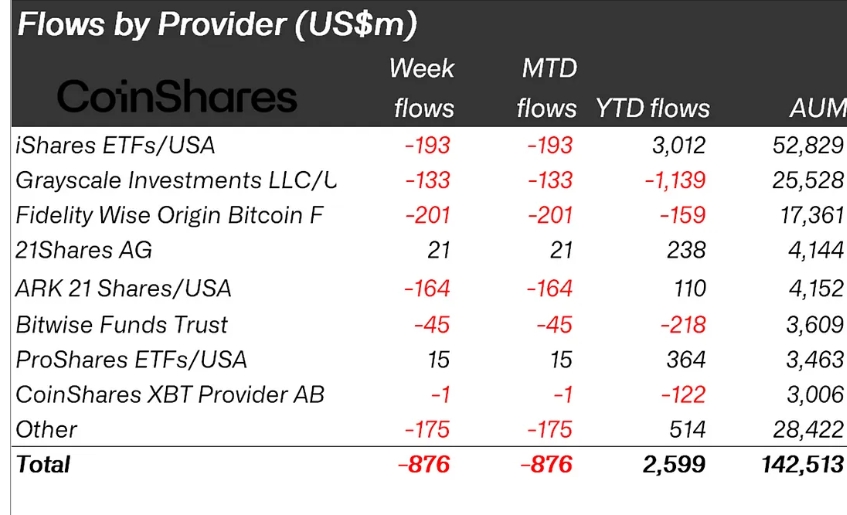

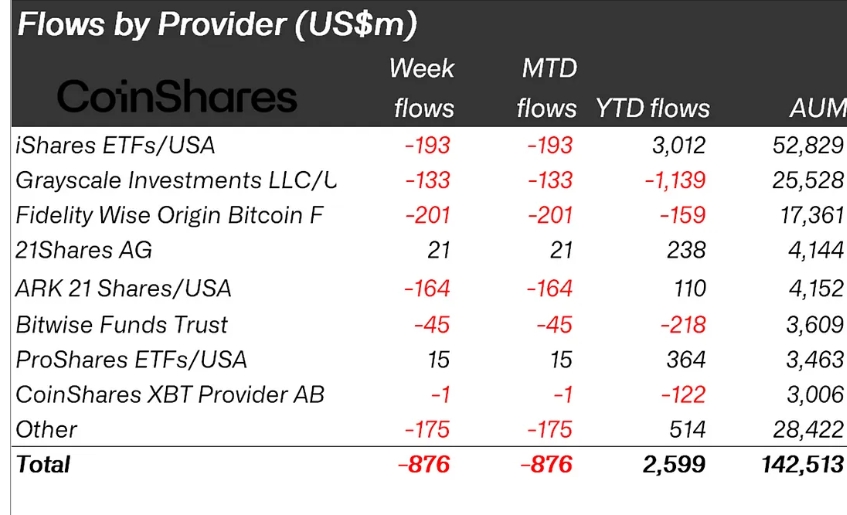

US investors led the retreat, withdrawing $922 million. Meanwhile, European countries took the opposite approach – Switzerland added $23 million, Canada invested $14.7 million, and Germany contributed $13.3 million.

“The market has shown signs of capitulation,” said James Butterfill, CoinShares’ Head of Research. “We believe several factors contributed to this trend, including the recent Bybit hack, a more hawkish Federal Reserve, and the preceding 19-week inflow streak totalling US $29 billion.”

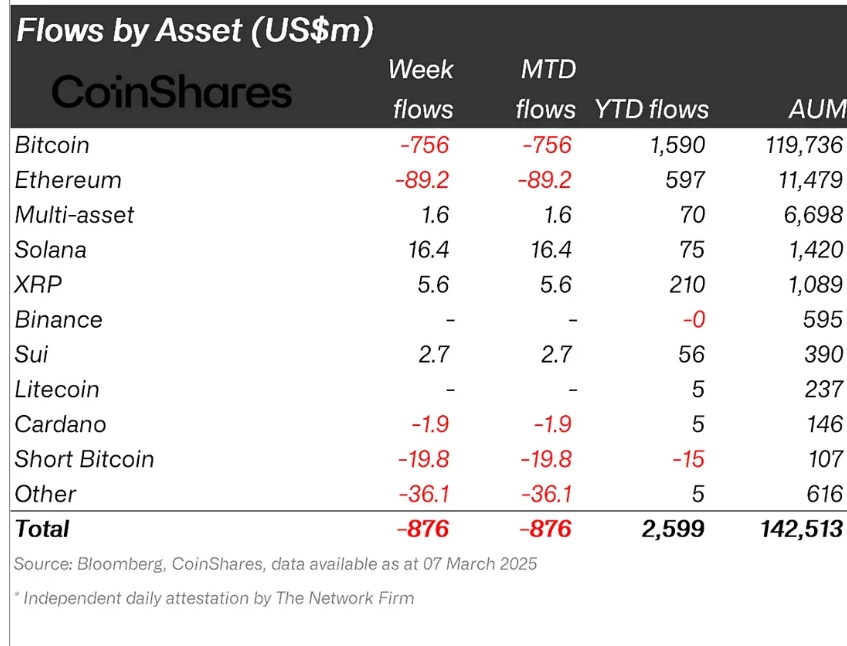

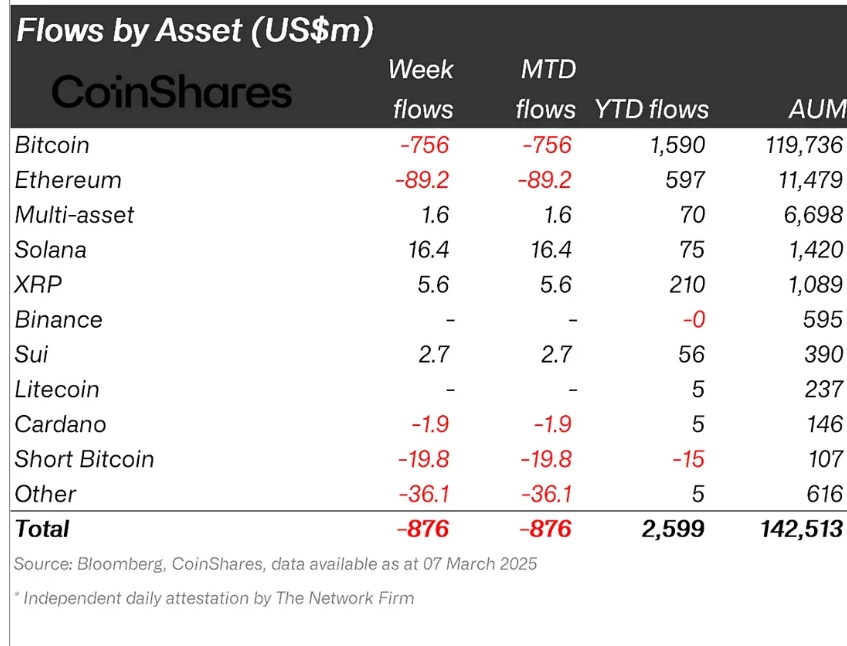

Bitcoin products suffered most, accounting for $756 million in outflows. Even short-Bitcoin products, which normally gain when sentiment turns negative, lost $19.8 million — their biggest drop since December 2024.

The ongoing sell-off has shrunk total assets under management (AUD) to $142 billion, down $39 billion from recent highs. This marks the lowest point since mid-November 2024.

Source: CoinShares

Among providers, Fidelity Investments took the biggest hit with $201 million in outflows. BlackRock’s iShares ETFs lost $193 million, while Grayscale Investments saw $133 million exit. Despite these losses, BlackRock still dominates the market with $52.8 billion in assets.

Source: CoinShares

The negative trend touched most major cryptocurrencies. Ethereum lost $89 million, Tron dropped $32 million, and Aave saw $2.4 million leave.

Not all crypto assets suffered, however. Solana attracted $16.4 million in new money, while XRP gained $5.6 million and Sui brought in $2.7 million. This suggests investors are being selective rather than abandoning the entire sector.

The year-to-date inflows for crypto ETPs have now dropped to $2.6 billion, substantially below the previous month’s figures when the sector enjoyed a 19-week streak of positive flows.

The negative sentiment also affected blockchain-related stocks, with their ETPs losing $48 million last week.

This shift comes as rising interest rates and security worries make traditional investments like Treasury bills more attractive compared to volatile crypto assets.