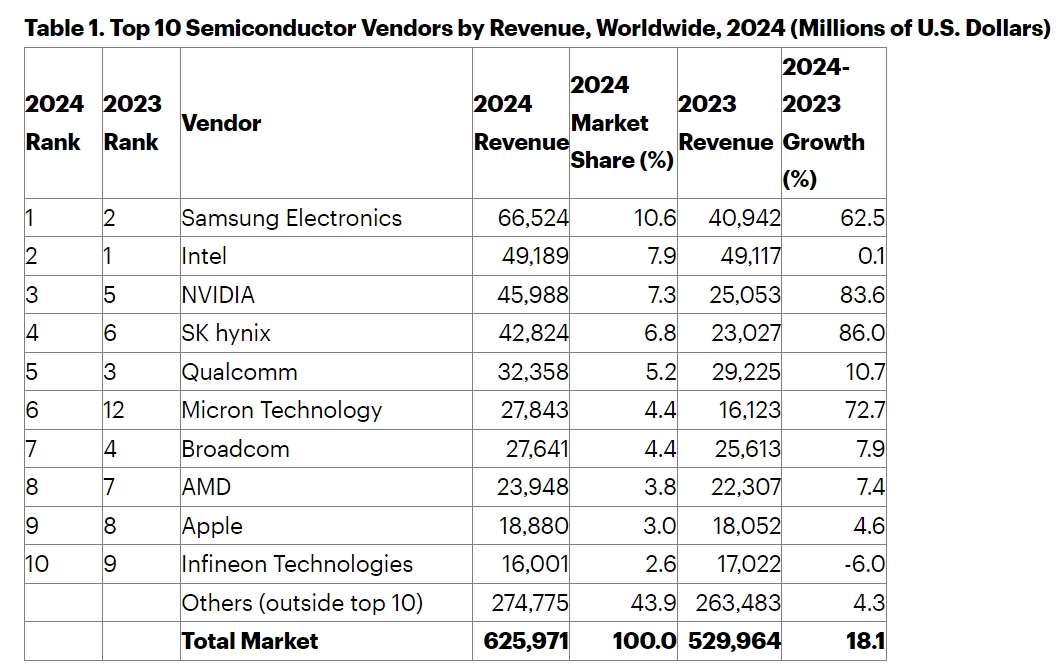

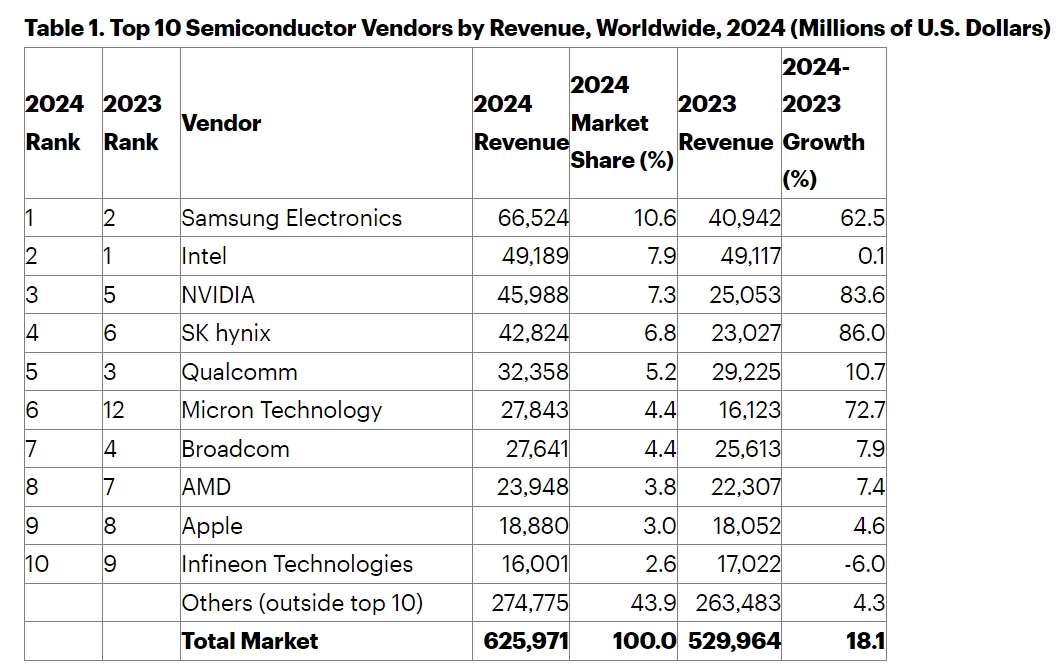

Intel fell off its position as the world’s largest semiconductor company in 2024, Gartner reports.

Samsung Electronics overtook the spot, powered by strong memory chip sales and surging demand for artificial intelligence (AI).

The South Korean tech giant generated $66.5 billion in revenue, claiming 10.6% of the global semiconductor market. Meanwhile, Intel’s revenue stayed flat at $49.2 billion, marking the end of its long-standing market leadership.

Source: Gartner

The global semiconductor market itself grew by 18.1% in 2024, reaching $626 billion. Data center semiconductors contributed $112 billion in revenue, up from $64.8 billion the previous year.

“Graphics processing units and AI processors used in data center applications were the key drivers for the chip sector in 2024,” said George Brocklehurst, VP Analyst at Gartner. “The rising demand for AI and generative AI workloads led data centers to become the second-largest market for semiconductors in 2024, behind smartphones.”

Nvidia capitalized on the AI boom, with semiconductor revenue jumping 84% to $46 billion, securing third place in global rankings. SK hynix went fourth with an 86% revenue increase, driven by strong demand for AI memory chips.

The memory chips segment saw revenue increase by 71.8% in 2024, with DRAM and NAND flash growing more than 75% year-over-year. High-bandwidth memory (HBM) represented 13.6% of total DRAM revenue in 2024, and Gartner predicts its share will reach 19.2% by 2025. The research firm expects HBM revenue to increase 66.3% to $19.8 billion next year.

Only eight of the top 25 semiconductor vendors saw revenue declines in 2024. Infineon Technologies is among the few that are reporting losses. The German chipmaker’s revenue fell 6% to $16 billion, affected by weakness in the automotive and consumer sectors.

Intel, however, faced multiple setbacks beyond its market position. The company canceled its next-generation GPU architecture, Falcon Shores, and pushed back its Clearwater Forest Xeons to 2026. These decisions followed former CEO Pat Gelsinger’s exit after a $16.6 billion loss in the third quarter.

Intel also announced that it would cut more than 15,000 jobs, aiming to reduce costs and streamline operations following a major loss in its second quarter.

The semiconductor industry’s recovery looks set to continue into 2025. Gartner expects the global semiconductor market to reach $705 billion this year. Moreover, chip inventory levels are stabilizing after the surpluses seen in 2023, creating healthier market conditions.