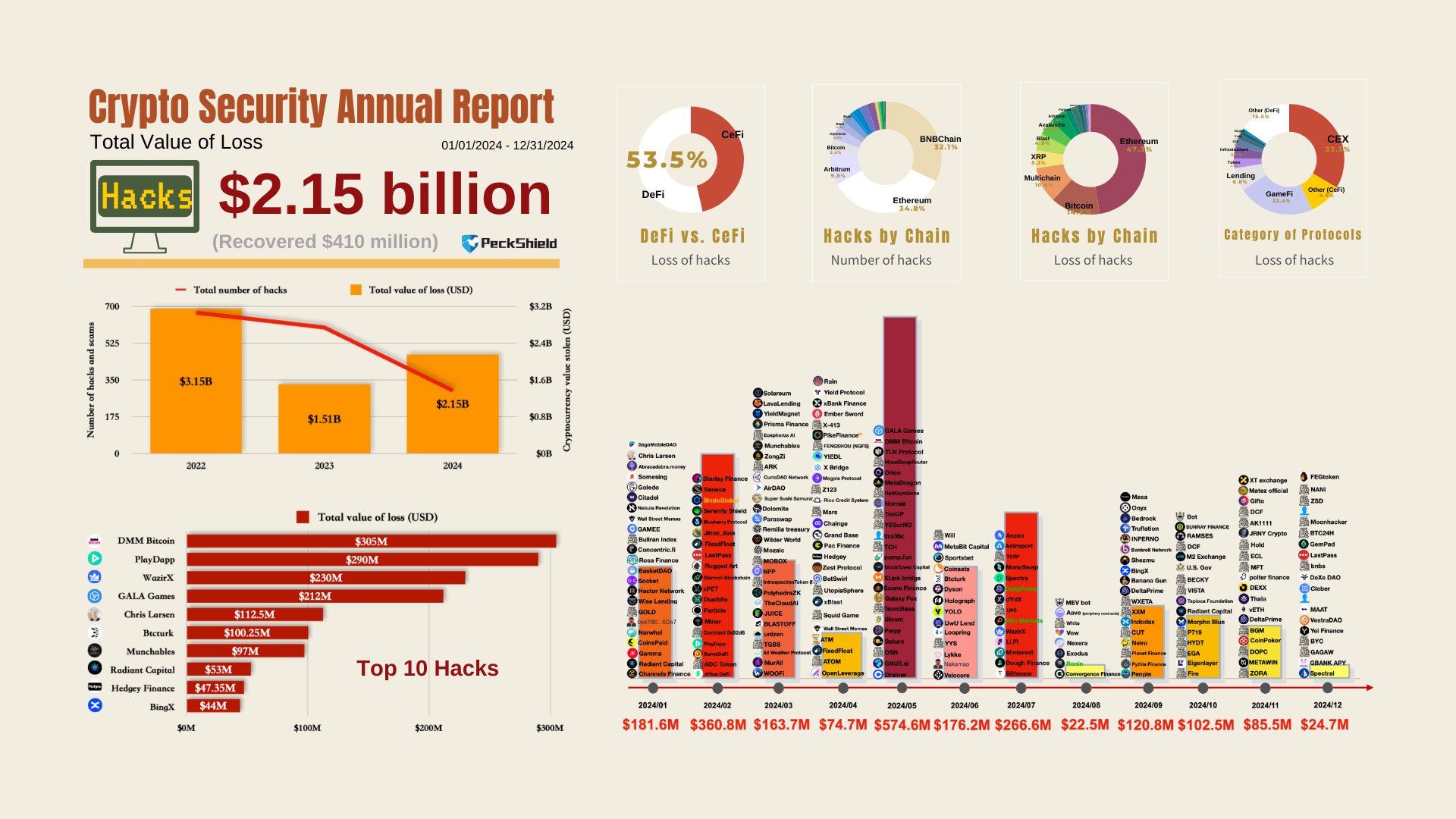

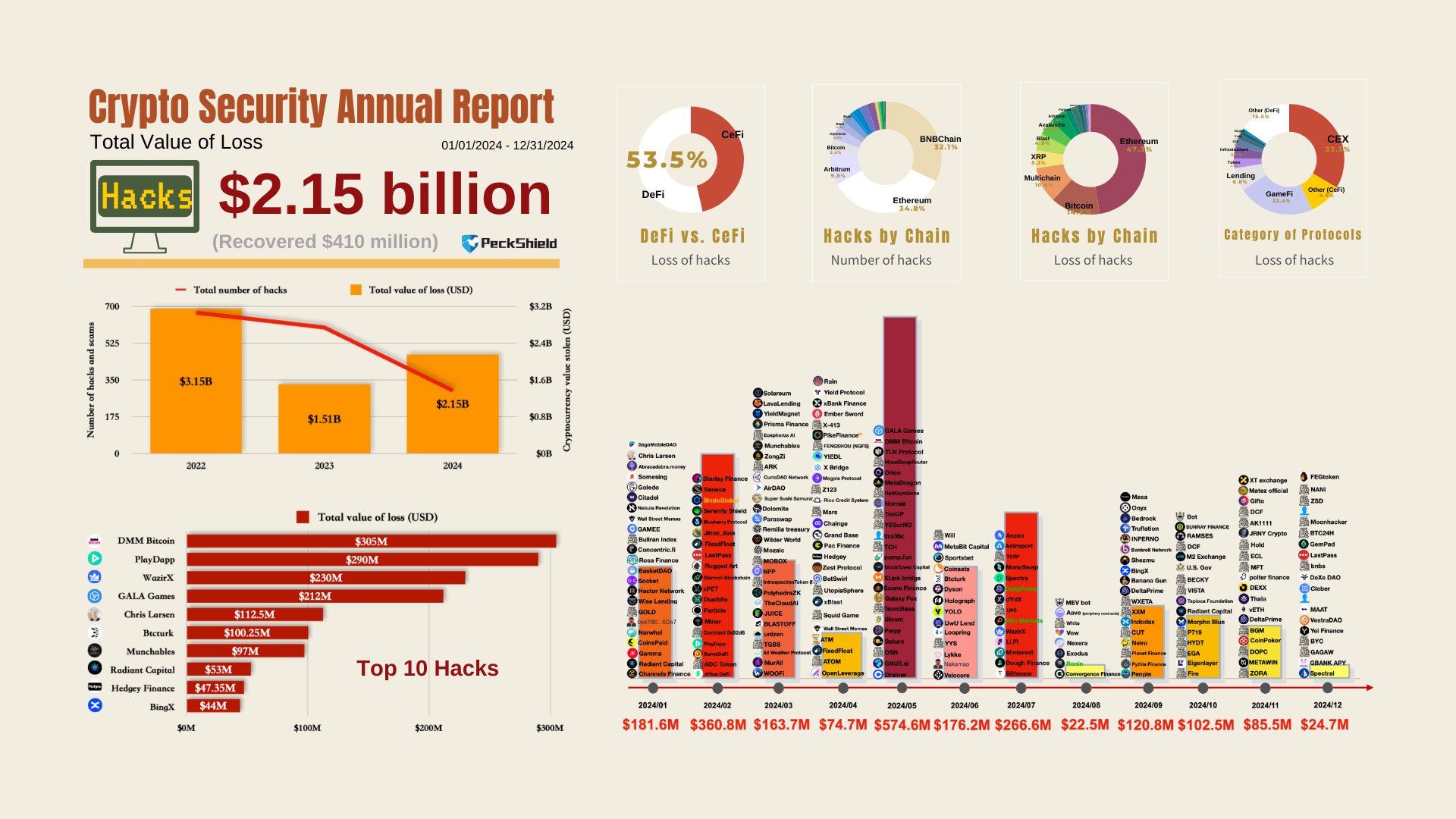

Cryptocurrency hackers and scammers stole $3.01 billion in 2024, according to blockchain security firm PeckShield. This marks a 15% increase from the previous year’s losses of $2.61 billion. Despite this concerning trend, security teams managed to recover nearly half a billion dollars of stolen funds.

Source: PeckShieldAlert on X

“This total includes $2.15B stolen from crypto hacks and $834.5M stolen from scams,” PeckShield reported on January 9. “Notably, [about] $488.5M worth of stolen cryptos has been recovered.”

May 2024 proved particularly devastating for the crypto industry, with losses totaling $662.2 million. The biggest single attack targeted Japanese exchange DMM Bitcoin, which lost $308 million in the same month due to a security breach. The attack was so severe that the company announced it would shut down its operations by March 2025. December showed the lowest monthly losses at $46.5 million.

Several other major platforms suffered substantial losses throughout the year. PlayDapp experienced a combined loss of $528 million through a hack and Bitcoin scam. This was followed by the Indian exchange WazirX and the gaming platform Gala Games, which lost $230 million and $212 million respectively.

Source: PeckShieldAlert on X

Ethereum, one of the most popular blockchain networks, was hit hardest. It was targeted in 34.8% of all attacks and lost 47.3% of the total stolen funds. Bitcoin followed, with attacks that increased as its price went up.

Decentralized finance (DeFi) platforms, which operate without traditional banking middlemen, remained the prime targets for hackers. These platforms use smart contracts to handle transactions, making them particularly vulnerable to technical exploits. This trend rose 13% more from 2023.

Other security firms revealed even more findings about crypto crime in 2024. Security researchers at CertiK found phishing scams to be the most damaging type of attack in 2024. Threat actors of this type stole over $1 billion across 296 incidents. Cyvers revealed an even more alarming trend: sophisticated “pig butchering” schemes that defrauded investors of $3.6 billion.

Security experts point to both progress and problems in protecting crypto assets. While the total amount stolen increased, the number of successful attacks decreased compared to 2022. This suggests better security measures are having some effect.

Looking ahead to 2025, industry experts warn about new challenges. Notably ones powered by artificial intelligence. “Phishing tactics will certainly evolve in 2025, especially as AI develops,” said a spokesperson from CertiK.

Law enforcement agencies worldwide are strengthening their response to crypto crime. The FBI partnered with blockchain analytics companies throughout the year, while France’s gaming authority launched investigations into fraudulent crypto operations.

Research has shown that these attacks affect both crypto and traditional financial markets. When hackers strike major crypto platforms, it can cause price swings in both markets. As crypto continues to grow, protecting it from hackers isn’t just about securing digital assets anymore – it’s about maintaining stability across all financial markets.