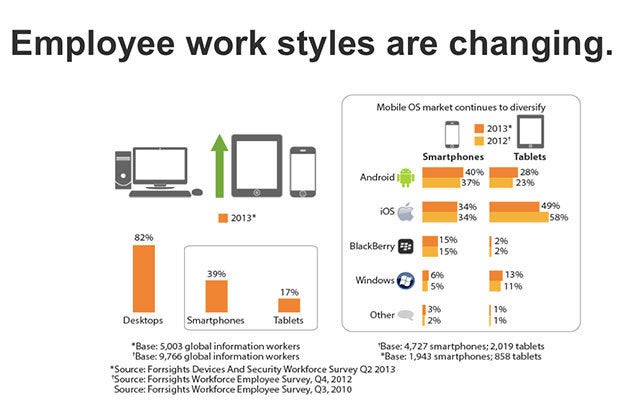

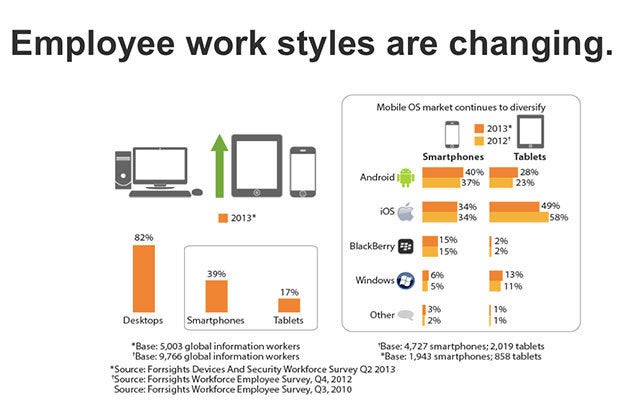

Merely a decade ago, you’d go to your job the company would likely provide you with a computer to work on. Maybe they would issue you a Blackberry. Today, so much of what we need for work is shifting to our smartphones tablets. use these devices daily to answer emails, peruse spreadsheets, even cobble together a last minute presentation on the train ride to the office. This new mobile lifestyle has made us much more efficient workers, but it’s still a headache for many large companies to allow its employees to bring Android devices on board.

That’s why ’s recent acquisition of Divide is a significant step forward for the platform. Divide is an app that offers users a sequestered encrypted Home screen business apps, all manageable by your corporate IT department. will surely build its key features into Android, so that employees like you me can actually consider bringing an Android device to work without the worry that it will be turned away for its lack of security features, or that IT will have comm over our entire device (only the encrypted safe “sbox.” It means that is getting more serious about Android’s business future.

Changing the conversation

According to Forrester Research, about 40 percent of business professionals use an Android phone for work, while 28 percent utilize Android-powered tablets. Those are significant numbers, but there is still plenty of trepidation about fully initiating the platform into the so-called “bring your own device” (BYOD) Era. “Companies are stoffish around Android for security or manageability,” said tian e, an analyst serving infrastructure operations professionals at Forrester. “[Divide] could easily go into strengthening improving Android for the enterprise.”

Divide is an app that offers sequestered partitions for your work apps your personal apps.

Consider the multitude of Android applications that have fallen to security breaches in the last year, including atsApp, Outlook.com, more recently, Spotify. ile there is plenty of evidence that iOS, ndows one, BlackBerry have had their fair share of vulnerabilities, it’s Android that seems to have been permanently stamped with the worst reputation, even as does its best to beef up security.

“It validates our belief that Android is a viable platform for Enterprise small-medium-business use,” said Rob Grapes, vice president of marketing at Graphite, a company that offers a system-level virtualization container solution for Android. ” has been moving away from including everything with their OS pushing their value up into the apps their services.” Divide is just the next step of that process.

Shifting away from Samsung

It’s entirely possible that purchased Divide not only as a direct response to the critics who pegged Android as one of the least secure of mobile platforms, but to also help shift the conversation away from Samsung’s KNOX.

Samsung’s introduction of KNOX at least year’s Mobile rld Congress had a real impact. The company became a “champion” of the operating system by sites like CRN, a news source for IT professionals, because it was first to implement pseudo-native security features, like SAFE (Samsung Approved for Enterprise) extensions, right out of the box on its best-selling Android devices. “It’s recognized as the great Android hope when it comes to security in the enterprise,” wrote CRN.

KNOX has taken Android’s corporate users by storm.

It’s no secret that Samsung has long been trying to build its products into its own ecosystem, but ’s acquisition of Divide could slow down the process, if not cease it completely. The Android-maker is attempting to appeal to those who want to use the platform at work, but it needs to reel in those who swear by KNOX, too. Divide could very soon come packed as part of the stard suite of core Android apps, thus entirely negating the need for Samsung’s KNOX.

Fixing fragmentation

For Android to play nice with corporations, it needs to address the issue of fragmentation that permeates throughout its device ecosystem. has already done plenty to try rid itself of this complex issue—building important functions into easily-updated apps instead of the core OS, for instance, proclaiming that it will only support its Nexus devices for up to 18 months—but its acquisition of Divide is also another key to winning this precarious battle.

How to fix fragmentation? Ensure other manufacturers don’t veer off on their own.

“This notion that people can just bring in whatever [device] they want is not really what goes in in the corporate environment,” said ll Stofega, director of mobile phone research at IDC. “It has to be managed…it has to be controlled.” Stofega is referring to the ease of managing devices with Mobile Device Management (MDM) software, which IT departments use to distribute applications, data, configuration settings over the air to linked mobile devices. This becomes tricky to do when manufacturers, like Samsung, require their own separate management software. “Managing Samsung [devices] differently than another Android [device] becomes a bit of a headache,” added e. “From the perspective of an enterprise, they just want to make sure that all the devices that come in can work.”

th Divide integrated into stock Android, Samsung could consider reverting back to the operating system’s native offering—or perhaps would make it a requirement. It certainly would entice IT departments to accept any Android device that runs the latest version of Android, regardless of manufacturer, as part of a BYOD program. “Android is something that [an IT department] knows it must support because there are that many devices out there,” said e.

More reasons to buy an Android device

The more Android devices get into consumers’ hs, the more reach has around the world. The company isn’t exactly making a profit on its Nexus line of devices, but it is extending its reach through all those devices out there in the wild. It’s even better if it can do so in the enterprise.

“en companies look think about purchasing tablets for employees…they end up thinking about the id,” explained e, factoring in the ease of device management for iOS devices. But if can make managing Android devices a simpler endeavor, companies will allow employees to consider the devices for work use—especially since they’re not as costly as Apple’s.

A Nexus device is a fraction of the cost of Apple’s id.

“ople are looking at this enterprise market as a place to sort of rejoice their shipments,” said Stofega. “[It’s a] waterfall effect. If you have somebody going in to the market….. pretty soon you’re green, blue, red, yellow without really knowing it.” Stofega added that Microsoft is already seeing some success with this particular business strategy, citing Office 365 as a prime example. “It’s always about [companies] exping… more about feeding that core business of theirs. They have to look at a new market. This is one that’s ripe for the picking.”

‘ve yet to see where will take Divide once it’s fully under its wing, but like its acquisition of QuickOffice two years ago, the move is indicative of the company’s attempt to be taken seriously by big businesses. If we’re living in a post- era, all of our post- computing devices need to work everywhere a does, that includes the corporate workplace.